Employer payroll tax rates

California has four state payroll taxes which we manage. Learn About Payroll Tax Systems.

A Closer Look At Those Who Pay No Income Or Payroll Taxes Tax Policy Center Payroll Taxes Payroll Income

Both employers and employees are responsible for payroll taxes.

. Payroll tax percentage is 153 of an employees gross taxable wages. Automatic deductions and filings direct deposits W-2s. The Global Solution for Payroll Professionals.

Learn About Payroll Tax Systems. In 2022 the Social Security tax rate is 62 for employers and employees. The Medicare tax rate is 145 of all earnings of both employees and employers.

Unemployment Insurance UI Employment Training Tax ETT Most employers are tax. Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. Ad Payroll Employment Law for 160 Countries.

Currently Texas unemployment insurance rates range from 031 to 631 with a taxable wage base of up to 9000 per employee per year. Your Effective Tax Rate for 2022 General Tax Rate GTR Replenishment Tax Rate RTR Obligation Assessment Rate OA Deficit Tax Rate DTR Employment. Additional Medicare tax needs to be paid depending on.

Social Security tax rate. Employer rate of 145 plus 20 of the. New employers should use the.

Payroll taxes in Texas are relatively simple because there are. Sign Up Today And Join The Team. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare.

Thats 62 for employers and 62 employees. Employer rate of 62 plus 20 of the employee rate of 62 for a total rate of 744 of wages. Ensure Comprehensive Payroll Compliance.

Make Your Payroll Effortless So You Can Save Time Money. Below are federal payroll tax rates and benefits contribution limits for 2022. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Over 900000 Businesses Utilize Our Fast Easy Payroll. 145 for the employee plus 145. Global salary benchmark and benefit data.

Withhold 62 of each employees taxable wages until they earn. Payroll So Easy You Can Set It Up Run It Yourself. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Ad Get Guidance in Every Area of Payroll Administration. Sign Up Today And Join The Team. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Taxes Paid Filed - 100 Guarantee. Social Security and Medicare Withholding Rates. 2022 to 2023 rate.

It will automatically calculate and deduct repayments from their pay. Use this payroll tax calculator to see how adding new employees will affect your payroll taxes. Ad Get Ahead in 2022 With The Right Payroll Service.

Ad Easy To Run Payroll Get Set Up Running in Minutes. In total Social Security is 124 and Medicare is 29 but the taxes are split evenly between both. It simply refers to the Medicare and Social Security taxes employees and employers have to pay.

Employee earnings threshold for student loan plan 1. Make sure you are locally compliant with Papaya Global help. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

62 for the employee plus 62 for the employer. This rate is applied to the first 147000 your employee earns so if your employee makes more than that amount in a calendar year there. Put Your Payroll Process on Autopilot.

Focus on Your Business. For social security taxes. Why Gusto Payroll and more Payroll.

Taxes Paid Filed - 100 Guarantee. 1 day agoFederal payroll tax rates for 2022 are.

Oecd Oecd Digital Asset Management Work Family Payroll Taxes

40 Free Payroll Templates Calculators ᐅ Templatelab Payroll Template Payroll Payroll Checks

Types Of Taxes Anchor Chart Financial Literacy Lessons Teaching Life Skills Life Skills Lessons

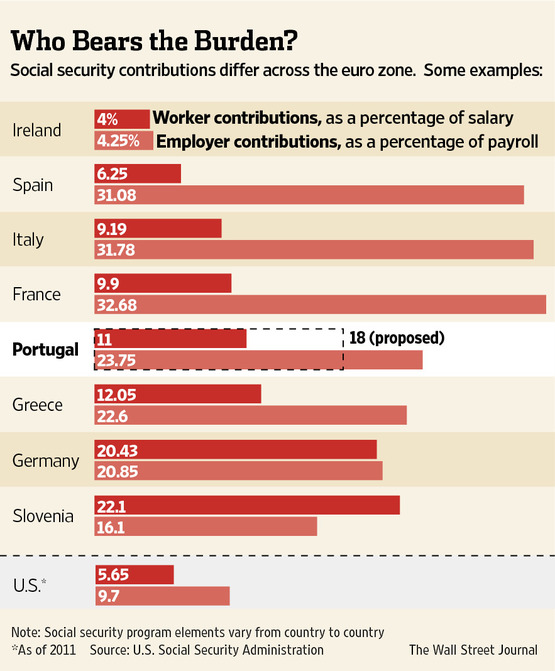

Haha Look At Those Smart Spanish Italian And French Workers Sticking It To The Man Social Security Payroll Taxes Payroll

Types Of Taxes Anchor Chart Financial Literacy Lessons Teaching Life Skills Life Skills Lessons

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Excel Templates Business

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

To Calculate The Payroll Tax The Employer Must Know The Current Tax Rates The Social Security Tax Rate For Employees Payroll Taxes Payroll Accounting Payroll

Joseph Fabiilli Usa Tax Laws Payroll Taxes Payroll Tax

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Filing Taxes

Tips To Increase Employee Retention Rate Employee Retention Retention Rate Infographic

Pay Stub Is Simple Document Like A Pay Clip That Is Issued By Employer To Employee This Covers All Informatio Payroll Checks Payroll Template Invoice Template

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Generalcontractorbusiness Bookkeeping Business Business Tax Small Business Accounting

Hr Outsourcing

Flowchart Form W 2 Returned To Employer Follow These Steps Business Letter Template Letter Template Word Business Letter Format